Are you looking to grow your wealth with stocks?

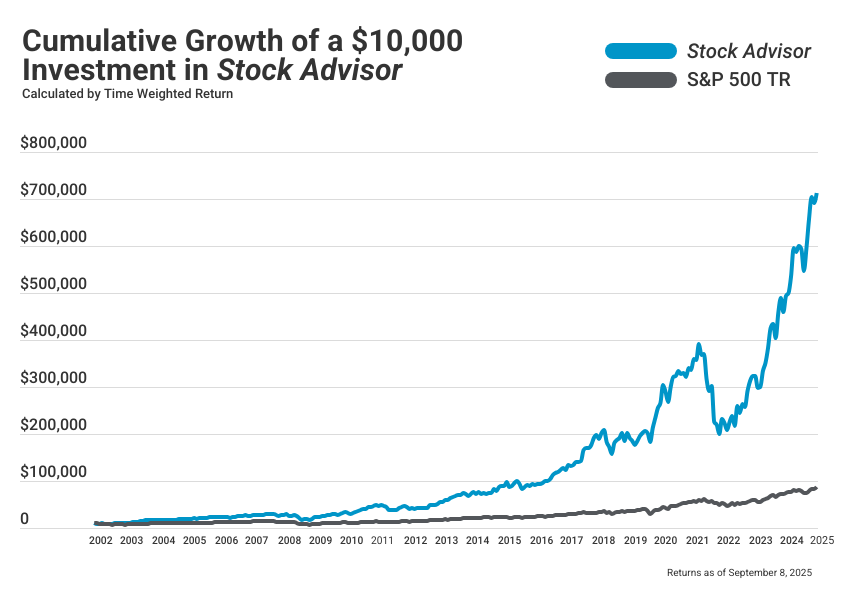

Motley Fool’s Stock Advisor service promises to help everyday investors make smarter stock picks with an average return of 600%+ over the last 5 years.

But does it live up to the hype? In this review, we’ll dive deep into the service’s features, performance, pricing, and whether it’s truly worth your investment.

What is Motley Fool Stock Advisor?

Launched by The Motley Fool, a respected financial advisory firm, Stock Advisor is a premium subscription service designed to help both novice and experienced investors identify top stock picks.

The service provides expert stock recommendations, curated by Motley Fool’s seasoned analysts.

With two new stock recommendations each month, Stock Advisor aims to deliver high-growth stocks that beat the market.

Who is Motley Fool Stock Advisor For?

Motley Fool’s Stock Advisor is ideal for long-term investors looking for:

- Hands-off investment strategies: Stock picks made by financial experts.

- A diverse portfolio: Recommendations across various sectors such as tech, healthcare, and consumer goods.

- Investors wanting to outperform the market: With historical returns that have consistently outperformed the S&P 500.

Key Features of Motley Fool Stock Advisor

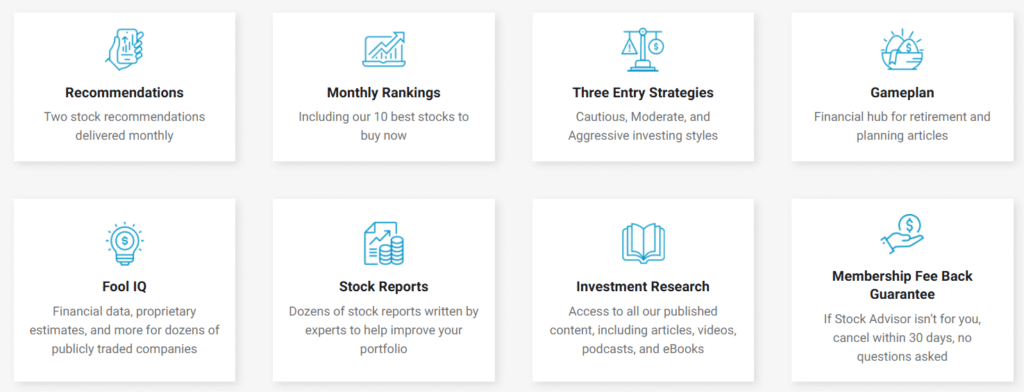

1. Monthly Stock Recommendations:

Every month, Stock Advisor offers two stock picks that are designed to offer long-term growth. Each pick comes with an in-depth analysis of why the stock is recommended, its growth potential, and the risks involved.

2. Performance Tracking:

Motley Fool’s Stock Advisor boasts an impressive track record, with returns 600% higher than the S&P 500 over the last 5 years. This performance is clearly tracked and updated monthly, which allows you to see exactly how the service has done.

3. Educational Resources:

Stock Advisor offers a wealth of learning materials to help investors understand stock market fundamentals, the best strategies for long-term investing, and how to interpret stock performance data. This is great for beginners looking to learn while they invest.

4. Motley Fool’s Community and Expert Insights:

Subscribers have access to a community forum and expert insights, where investors can discuss recommendations, strategies, and market trends. This social aspect helps you stay updated and engage with like-minded individuals.

5. Risk Management and Diversification Advice

Stock Advisor provides diversification and risk management advice with each recommendation. It helps investors build a balanced portfolio that aligns with their financial goals.

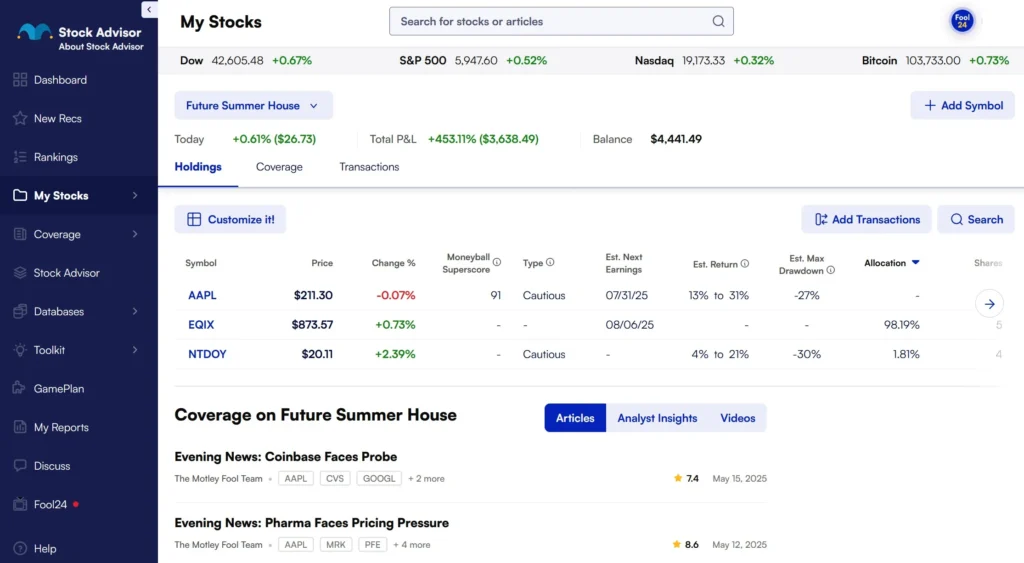

Portfolio Tracking Tool

Motley Fool offers a portfolio tracker to monitor the performance of your investments in real-time. This tool helps you keep track of stock recommendations and adjust your strategy accordingly.

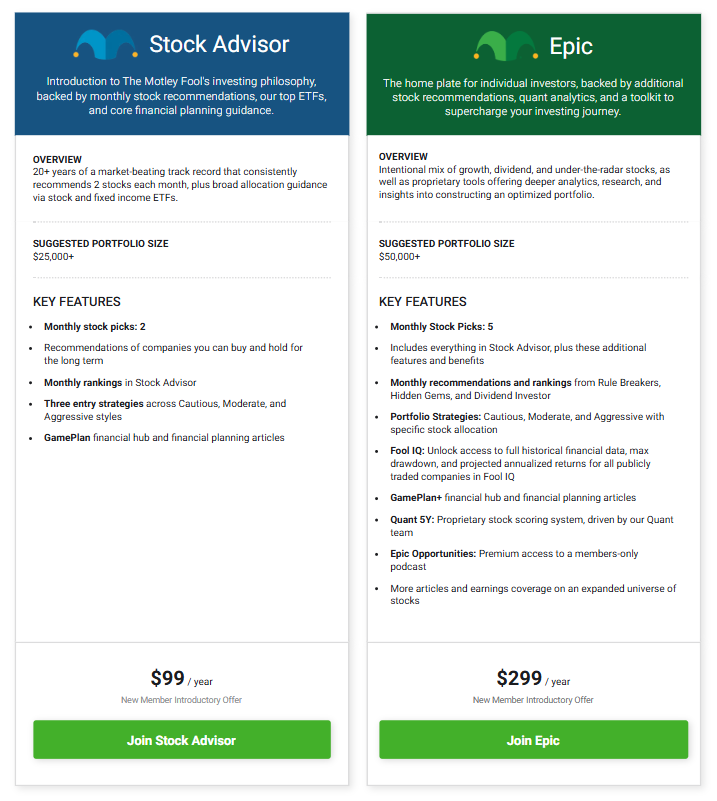

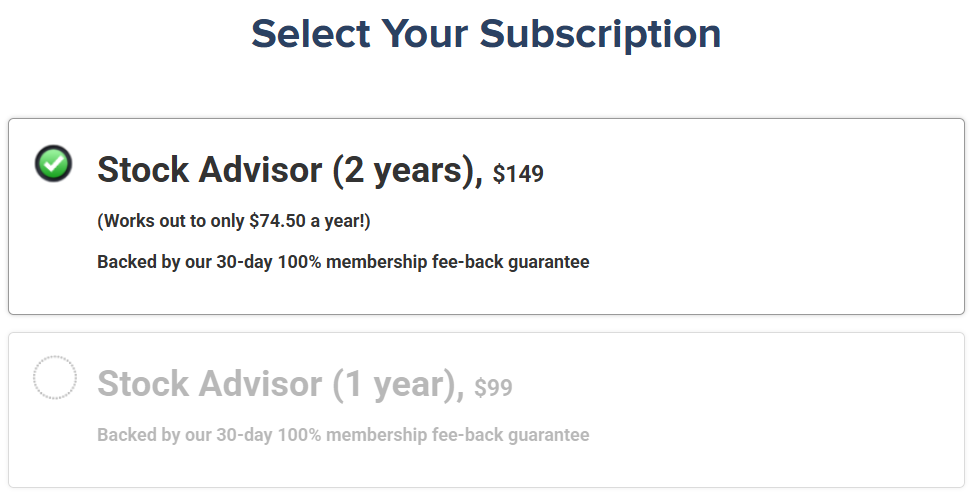

Advance Pricing Plan

This is the detailed pricing plan according to which you can choose and decide which one to opt for.

Stock Advisor – $99/year

- 2 stock picks per month

- Great for long-term investors

- Includes rankings, strategies, and financial planning tools

- Ideal for portfolios of $25,000+

Epic – $299/year

- 5 stock picks per month

- Includes everything in Stock Advisor + extras

- Access to Rule Breakers, Hidden Gems, and more

Is it worth the cost?

For most investors, especially those new to stock trading, Stock Advisor provides great value for money. With the average stock pick outperforming the market by more than 6x, the service can more than pay for itself with just one successful stock pick.

Motley Fool Stock Advisor vs. Competitors

While Stock Advisor is highly rated, how does it stack up against other stock advisory services? Here’s a quick comparison:

| Feature | Motley Fool Stock Advisor | Stockpile | Seeking Alpha Premium |

|---|---|---|---|

| Monthly Stock Picks | Yes | No | Yes |

| Historical Performance | +600% vs S&P 500 | Not available | Not published |

| Educational Resources | Extensive | Limited | Extensive |

| Pricing (Yearly) | $199 | $100 | $239 |

How to Get Started with Motley Fool Stock Advisor

Getting started with Motley Fool Stock Advisor is easy. Here’s how you can begin:

1. Engage with the Community

Join the Motley Fool community to discuss stock picks, share insights, and learn from other investors.

2. Sign Up for the Subscription

Visit the Motley Fool website and choose the subscription plan that fits your needs (either 1-year or 2-year plan). You’ll be prompted to create an account.

3. Access the Dashboard

Once you’ve signed up, you can access the Stock Advisor dashboard where you’ll find monthly stock picks, educational resources, and performance tracking tools.

4. Start Receiving Stock Recommendations

Every month, you’ll receive two stock recommendations. Be sure to review the detailed reports, including why the stock was chosen, its growth potential, and the associated risks.

5. Track Your Portfolio

Use the portfolio tracking tool to monitor your investments and ensure they’re aligned with your goals. You can adjust your portfolio as needed based on the performance of the recommendations.

User Testimonials and Reviews

Here’s what some users are saying about Motley Fool Stock Advisor:

“I’ve been following Motley Fool for years, and their recommendations have consistently outperformed the market. I’ve seen an average return of 20% per year on their picks!”

– John M., California

“The best thing about Stock Advisor is the transparency. They provide detailed explanations for every pick, and you can follow along with how those stocks are performing in real-time.”

– Emily R., New York

Final Rating: ⭐⭐⭐⭐⭐ (5/5)

Pros and Cons of Motley Fool Stock Advisor

| Pros | Cons |

|---|---|

| Outstanding Performance: Stock Advisor’s picks have outperformed the S&P 500 by over 600%. | Not a Get-Rich-Quick Scheme: Stock Advisor is for long-term investors. If you’re looking for short-term gains, this service may not be ideal. |

| Beginner-Friendly: The service’s educational tools make it easy for novice investors to understand how the stock market works. | Can Be Expensive: While the cost of Stock Advisor is reasonable, it might be out of reach for those with limited budgets. |

| Monthly Updates: You receive fresh stock recommendations twice a month, keeping you ahead of the game. | No Customization: The stock picks are pre-selected, so you can’t tailor them to specific industries or sectors. |

| Diversified Picks: The service covers a wide range of stocks, from growth to value investments. |

Conclusion: Is Motley Fool Stock Advisor Worth It?

Yes, it is!

For both new and experienced investors, Motley Fool Stock Advisor offers a wealth of resources, consistent returns, and a community of like-minded individuals.

If you’re looking for a long-term investment strategy that focuses on stock picks with high growth potential, Stock Advisor is definitely worth considering.

However, if you’re a short-term investor or someone who needs more personalized stock recommendations, this service might not be the best fit.

Frequently Asked Questions (FAQs)

Stock Advisor: $99/year with a suggested portfolio size of $25,000+.

Epic: $299/year with a suggested portfolio size of $50,000+.

Yes! The service includes educational resources and makes it easy for beginners to understand stock market principles.

Yes, you can cancel your subscription at any time within the first 30 days for a full refund.

Stock Advisor provides two new stock recommendations every month.

While there are many advisory services, Stock Advisor has proven to deliver significant returns, consistently outperforming the S&P 500.